Commercial truck depreciation calculator

A truck insurance is vital for any business as it financially protects the respective commercial vehicle from any damages that can be caused due to. Configure towing capacity payload maximum GVWR plus choose the standard 73L V8 Premium-rated or Economy-rated engine.

Commercial Truck Resale Values The Latest 2021 Trends Price Digests

New amassed depreciation balance as a line thing on your private companys monetary record called Less Accumulated Depreciation.

. Find new and used cars for sale on Microsoft Start Autos. The most accurate way to calculate the cost of depreciation for a fleet is by using the accelerated method. CEVS rebate is only applicable for cars registered after 1-Jan-2013.

Either way one of the more popular options for people who wants action and comfort while driving is getting a pickup truck. Class A Combination vehicles with a gross combination weight rating GCWR of 26001 or more pounds provided the GVWR of the vehicles being towed is. New cars depreciate the second you leave the lot.

GDS using 200 declining balance. MACRS depreciation schedule gives you 3 methods under the GDS and 1 depreciation method under the ADS. Businesses often miss great tax-saving opportunities because they arent aware certain tax breaks exist.

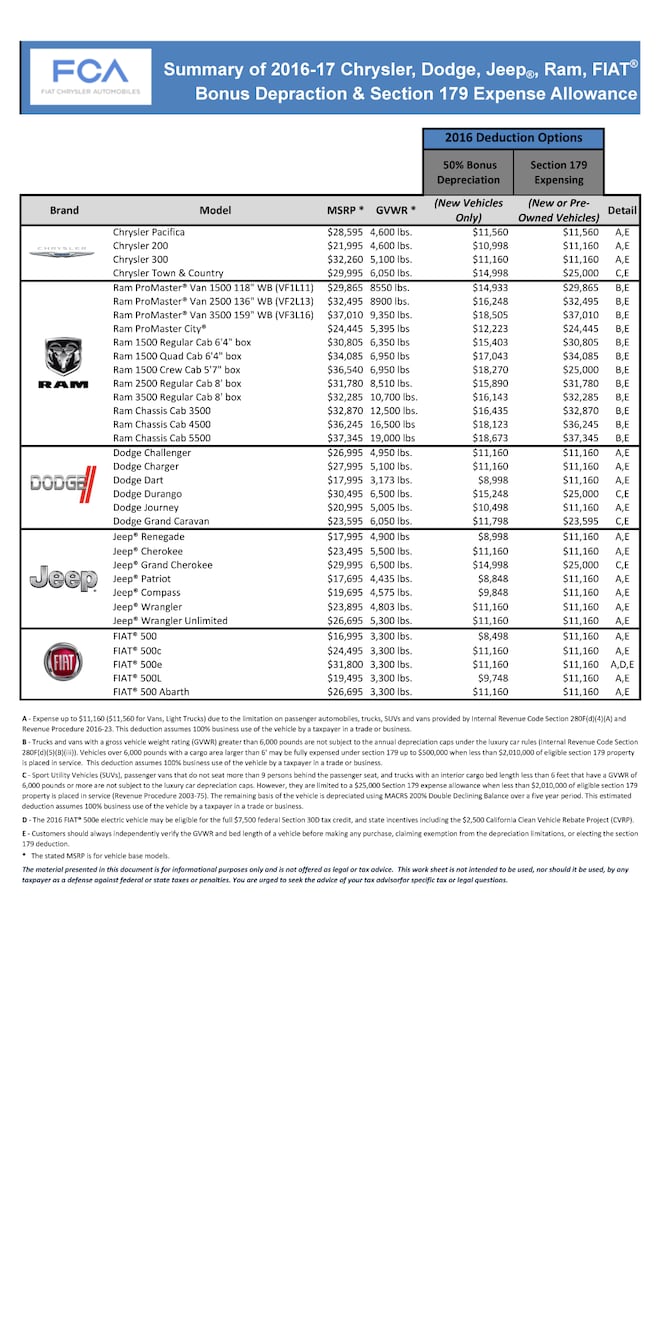

A Ram truck is generally considered qualified property for purposes of section 168k for US. Since 1948 the Ford F-150 has been Built Ford Tough - ready to work haul tow weekend trip more. Federal income tax purposes.

See Maximum Depreciation Deduction in chap-ter 5. Input details to get depreciation. We Make the Financing Process Hassle-Free.

Class A B and C. Buy from new car dealer parallel importer car auction etc. If a delivery truck is purchased by a company that cost is 100000 and the expected usage of the truck are 5 years then the business might depreciate the asset under depreciation.

6 to 30 characters long. NW IR-6526 Washington DC 20224. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2021 is 18200 if the special depreciation allowance applies or 10200 if the special depreciation allowance does not apply.

Depreciating Calculator the straight. These MACRS depreciation methods include. Commercial truck loans are not necessarily more difficult to obtain than personal truck loans but they are a different financial product and it is important to understand the.

To calculate the impact of depreciation compare an example for a commercial truck worth 100000. Subject to deduction of depreciation commercial vehicle insurance price or IDV is fixed at the commencement of the policy. Must contain at least 4 different symbols.

It starts with the large drop in value after the first year then levels out to a lower depreciation rate in the following years. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. So you wanted a more rugged ride or just expanding your car options from the hatchback your parents have gifted you.

To calculate your depreciation deduction for most assets you apply the general depreciation rules unless youre eligible to use instant asset write-off or simplified depreciation for small business. At the time of an unforeseen event when you need immediate assistance and support without being burdened by unnecessary delays and long-winded procedures we are there at your service to make things infinitely easy through our Claim Registration options. Decide Which Auto Loan is Best for You Use this calculator to compare two auto loans by filling in their specifics and.

Section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2021 is 18200 if the special depreciation allowance applies or 10200 if the special depreciation allowance does not apply. A Buyers Guide to Shopping For Your Next Truck. Depreciation limits on business vehicles.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. You dont have to worry about that steep depreciation with a used car. A truck insurance is a type of commercial vehicle insurance policy customized to suit trucks that are used within business functions such as for trucks used for delivery purposes pick-ups and goods transportation amongst others.

The 2023 Ford E-Series Cutaway comes in 3 model options including 2 with dual-rear wheels. View pricing upfit options. Drivers of vehicles that do not fall in Classes A B or C will be issued Class D non-commercial licenses.

ASCII characters only characters found on a standard US keyboard. The 200 or double-declining depreciation simply means that the. However depreciation is a major factor that contributes a lot to commercial vehicle insurance.

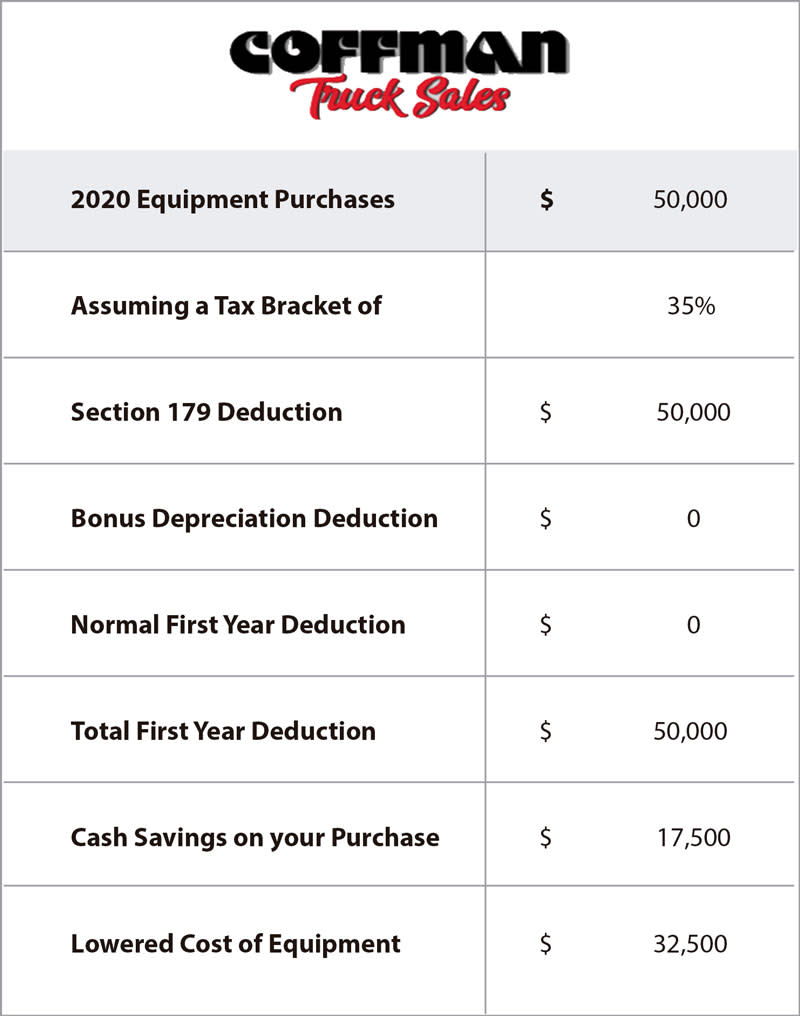

The general depreciation rules set the amounts capital allowances that can be claimed based on the assets effective life. SUV van truck parallel imported cars. Under Section 179 you can write-off 100 of the purchase price of the equipment you finance up to the yearly deduction limit.

Get 247 customer support help when you place a homework help service order with us. The smart depreciation calculator that helps to calculate depreciation of an asset over a specified number of years also estimate car property depreciation. Use this calculator to see if paying for you next car truck or SUV in cash is better than financing the vehicle with a low interest loan.

General depreciation rules capital allowances. Depreciation Like all vehicles trucks depreciate in value fairly quickly so the resale value will drop significant in the first year. S Reg Date.

The renowned F-Series trucks are now available in gas hybrid electric. You can depreciate the asset under a depreciation cost of 10000 a year for five years. The all-new F-150 Lightning uses zero gas has zero tailpipe emissions.

Published August 25 2019 by Benjie Sambas. Get 247 customer support help when you place a homework help service order with us. S CEVS Rebate.

Get a great deal on a great car and all the information you need to make a smart purchase. If you purchase equipment over the deduction limit of 1080000 you may qualify for bonus depreciation. The IDV is decided based on the manufacturers listed selling price and the brand of the vehicle.

There are three classes of commercial drivers licenses. You purchase a delivery truck worth 50000 and expect it to run for five years. This tax depreciation method gives you a significant tax deduction in the earliest years.

We welcome your comments about this publication and your suggestions for future editions. This means a taxpayer may elect to treat the cost of any qualified property as an expense allowed as a deduction for the taxable year in which the property is acquired and placed in service. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Used cars give you the opportunity to have features that may have been discontinued on new models.

Pin On Car Insurance

Depreciation Calculator Depreciation Of An Asset Car Property

Section 179 Tax Deduction Coffman Truck Sales

Heavy General Purpose Truck Depreciation Calculation Depreciation Guru

Bellamy Strickland Commercial Truck Section 179 Deduction

Commercial Truck And Van Incentives Specials

Heavy General Purpose Truck Depreciation Calculation Depreciation Guru

/double-declining-balance-depreciation-method-4197537-FINAL-9baf4fb736b74a1686dd768332f364b3.png)

Double Declining Balance Ddb Depreciation Method Definition With Formula

Projected Income Statement 5 Years On Existing Business Income Statement Business Planning Financial Planning

Commercial Vehicle Depreciation Finder Com

Accumulated Depreciation Overview How It Works Example

How To Calculate Depreciation Expense For Business

Simple General Ledger In Excel Format Have Following Parts Accounting Journal Excel Template Accounting Jour General Ledger Excel Spreadsheets Templates Excel

Depreciation

Bakers Recipe Template Chefs Resources Recipe Template Baker Recipes Recipes

Understanding Rental Property Depreciation 2022 Bungalow

Real Estate Profit And Loss Statement Form How To Create A Real Estate Profit And Loss St Profit And Loss Statement Certificate Of Completion Template Profit